Introduction

In pursuing higher education, students often face financial obstacles that can deter them from achieving their academic dreams. Recognizing these challenges, the Biden administration has introduced a student loan program to alleviate the financial burden on students. In this article, we will delve into the details of the “Loan for Biden Student” program, shedding light on eligibility criteria, the application process, benefits, and more.

Understanding Biden’s Student Loan Program

The “Loan for Biden Students” program is a government initiative aimed at making higher education more accessible and affordable. It offers financial assistance to eligible students, providing them with the means to pursue their educational goals.

Challenges Faced by Students

Students across the United States grapple with the escalating costs of tuition, textbooks, and living expenses. This financial burden can deter individuals from enrolling in colleges or universities and hinder their pursuit of academic excellence.

Eligibility Criteria

To benefit from this program, students must meet specific eligibility criteria. These criteria typically include factors like income, enrollment status, and citizenship. It is crucial for applicants to understand these requirements before proceeding with their applications.

Loan Application Process

The application process for Biden’s student loan is straightforward. Applicants must complete the required forms and provide the necessary documentation. The application is typically available online, making it convenient for students.

You can see this: WHAT INCREASES YOUR TOTAL LOAN BALANCE, AND WHAT CAN YOU DO ABOUT IT?

Interest Rates and Repayment Options

One of the advantages of Biden’s student loan program is its competitive interest rates and flexible repayment options. This ensures that students can repay their loans without undue financial stress.

Examining Federal and Private Loans

The major distinctions between federal and private loans are crucial for students to comprehend. Federal loans, like those made available under the Biden program, can have more favorable terms and safeguards.

Making Informed Decisions: How to Do It?

When thinking about borrowing money for higher education, students should be well-informed. Understanding the terms and circumstances of the loans they are looking for as well as carefully weighing their alternatives are required for this.

Change in Students’ Lives

The “Loan for Biden Students” initiative has the power to positively impact the lives of many students by giving them the financial assistance they require to excel academically and secure their futures.

Regular Falsehoods

It’s crucial to dispel prevalent myths regarding student debt and the Biden program. This may aid learners in making loan Options for Biden Students. In the modern world, education is the secret to seizing chances and securing a prosperous future. But for many students, the growing expense of higher education can be a major obstacle. President Biden has established a number of student loan schemes intended to offer financial aid to students in an effort to solve this issue. These programs, their advantages, and how to access them will all be covered in this essay.

The Importance of Education

Before delving into the world of student loans, let’s highlight the importance of education. A well-rounded education not only enhances personal growth but also plays a pivotal role in career development. It opens doors to better job prospects and economic stability.

The Challenge of Financing Education

While the value of education is clear, the cost of pursuing it can be a major challenge. Tuition fees, living expenses, and other educational costs can add up quickly. This is where student loans come into play, offering financial support to those who aspire to continue their studies.

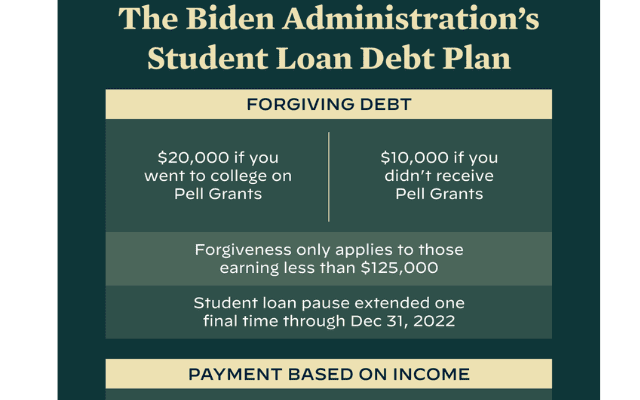

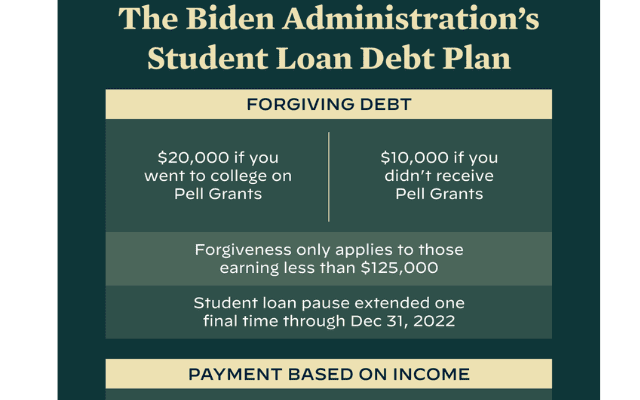

Depending on income repayment plans

The Biden administration has set repayment schedules, which are determined by family size and income. This reduces high monthly expenses.

You can see this: SPECTRUM BUSINESS FIBER | BOOSTING YOUR CAPABILITIES WITH ULTRA-FAST INTERNET

Deduction of Debt Programs

The focus on loan forgiveness in Biden’s student loan plans is another significant aspect. Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness are two of the several programs that provide borrowers with the possibility of having some of their loans forgiven.

How to Applying for Biden Student Loans

According to Kvaal’s prepared statements, student loan debt in our nation has gotten so high that it is depriving many students of the advantages of attending college. Some debts given to young adults last well into their retirement years and have little chance of being returned. Families and communities participate in these debt burdens.

After a conservative court determined that Biden could not cancel debts using a 2003 statute known as the HEROES Act, Biden instructed the Education Department to find an alternative route to loan relief.

The current attempt will be based on the Higher Education Act, a broad piece of legislation that grants the education secretary the right to forgive student loans, albeit the exact scope of that authority is up for legal argument. The department is implementing the negotiated regulations at this time.

Applying for Biden Student Loans

The Importance of Higher Education

Higher education plays a pivotal role in shaping one’s future, providing opportunities for personal and professional growth. However, the cost of pursuing a degree has been a significant hurdle for many aspiring students.

It has nearly tripled since the introduction of federal loans in the 1980s. Predicted earnings for graduates have diminished. For some majors, according to Forbes, bachelor’s degrees now underperform even an associate’s degree or just a high school diploma.

Christian theology, however, can cut through partisan debates on loan debt to the underlying moral issues through:

I. Background:

A. Student Loan Debt Crisis:

The United States is currently facing a student loan debt crisis, with outstanding student loan debt exceeding $1.5 trillion. This debt has far-reaching economic and societal implications, affecting borrowers’ financial well-being and ability to contribute to the economy.

B. Joe Biden’s Campaign Promises:

During his presidential campaign, Joe Biden promised to address the student loan crisis. He proposed a range of policies aimed at making higher education more affordable and reducing the burden of existing student loan debt.

II. The Biden Student Loan Plan:

An in-depth analysis of the changes proposed to the Public Service Loan Forgiveness (PSLF) program

A. Income-Driven Repayment Plans

Exploring Biden’s proposals for enhancing income-driven repayment plans and loan forgiveness after a set number of years.

B. Tuition-Free Community College

Overview of the plan to provide tuition-free community college education

Consequences for employment development and access to higher education

There are many Tuition-Free Community Colleges:

Apply for Tuition-Free Community College

C. Expanding Pell Grants

Analysis of the proposal to increase the maximum Pell Grant award

How this change would benefit low-income students and families

D.Cancellation of Student Loan Debt

Examination of the discussions surrounding the potential cancellation of a certain amount of student loan debt.

The criteria and implications of such cancellations

You can see this: SPECTRUM BUSINESS FIBER | BOOSTING YOUR CAPABILITIES WITH ULTRA-FAST INTERNET

III. Implications for Borrowers:

A. Relief for Borrowers

How the Biden plan provides immediate relief for borrowers struggling with loan repayment

The impact on borrowers’ financial stability and well-being

B. Access to Higher Education

How the plan’s provisions for free community college and increased Pell Grants can impact access to higher education

Potential changes in college enrollment rates and graduation rates

C. Impact on Credit and Financial Literacy

Analyzing how student loan forgiveness and debt cancellation could affect borrowers’ credit scores.

The importance of financial literacy in managing student loan debt

You can see this: WHAT INCREASES YOUR TOTAL LOAN BALANCE, AND WHAT CAN YOU DO ABOUT IT?

IV. Economic Implications:

A. Stimulating Economic Growth

Discussion of how reducing student loan debt could stimulate consumer spending and economic growth. The potential long-term benefits for the U.S. economy.

B. Labor Force Mobility

How reduced student loan debt could lead to increased labor force mobility and entrepreneurship

Implications for innovation and economic dynamism

C. Government Expenditure and Revenue

An examination of the fiscal impact of the Biden student loan plan

Balancing government expenditure with potential increased revenue and savings

V. SEO Considerations:

A. SEO and Content Relevance

How the topic of student loan reform fits into the broader SEO landscape.

Identifying relevant keywords and search phrases.

B. On-Page SEO Strategies

Techniques for optimizing content for search engines, including title tags, meta descriptions, and header tags.

The importance of high-quality, informative content.

C. Off-Page SEO Strategies

Strategies for promoting the content through link-building and social media

Building an authoritative online presence

Conclusion

In conclusion, the Biden student loan plan represents a significant effort to address the student loan debt crisis in the United States. It encompasses a range of ideas designed to help borrowers, increase access to higher education, and promote economic growth. This strategy has numerous and intricate ramifications that will have an impact on people’s lives and the overall economy in the short- and long-term. Furthermore, it’s vital to comprehend SEO tactics to make sure that this important information reaches its target audience and has an actual influence on debate and policy choices.

The Biden student loan plan is a pivotal issue that requires careful consideration, analysis, and an effective approach to dissemination to address the ongoing student loan crisis and promote financial well-being in the United States.

FAQs

1. How can I qualify for student loan forgiveness under Biden’s policies?

To qualify for student loan forgiveness, you typically need to meet specific income and public service requirements. It’s advisable to check the latest guidelines provided by the Department of Education.

2. What is the difference between federal and private student loans?

Federal student loans are offered by the government and come with benefits like income-driven repayment plans. Private student loans are offered by banks and other financial institutions, typically with different terms and conditions.

3. What are the advantages of student loan consolidation?

Student loan consolidation can simplify repayment by combining multiple loans into one and may lower your monthly payments. However, it’s essential to consider the potential drawbacks, such as losing certain loan benefits.

4. How can I avoid defaulting on my student loans?

To avoid default, make sure to stay in touch with your loan servicer, explore income-driven repayment plans, and communicate any financial hardships that may affect your ability to make payments.

5. What are the potential future changes in student loan policies?

Student loan policies are subject to change, influenced by various factors such as the political landscape and economic conditions. Staying informed and regularly checking for updates from official sources is advisable.